Back

Fintech

Investment Management

Book a review

Read more

+300K

Target users exposed

Over 29%

New investor activation

3 month

Integration timeline

Project Overview

Background

Banco Familiar, a leading financial institution, sought to enrich its core digital banking experience by providing customers with seamless access to sophisticated investment opportunities. The existing setup required customers to manage their primary banking and investment portfolios (run by Familiar Casa de Bolsa) across separate, disconnected platforms. This fragmentation created significant user friction, hindered cross-selling opportunities, and prevented customers from easily tracking their total financial health in one place.

Challenge

Design and integrate a comprehensive Investment Management module directly within the Banco Familiar mobile app. This module needed to securely display real-time investment data (capital and revenue) for both Guaraníes (₲) and Dollars (USD), enable effortless fund transfers for new investments, and support user-initiated redemptions (withdrawals and earnings) while meeting the distinct operational, legal, and security expectations of both the Bank and the Brokerage (Casa de Bolsa).

Objectives

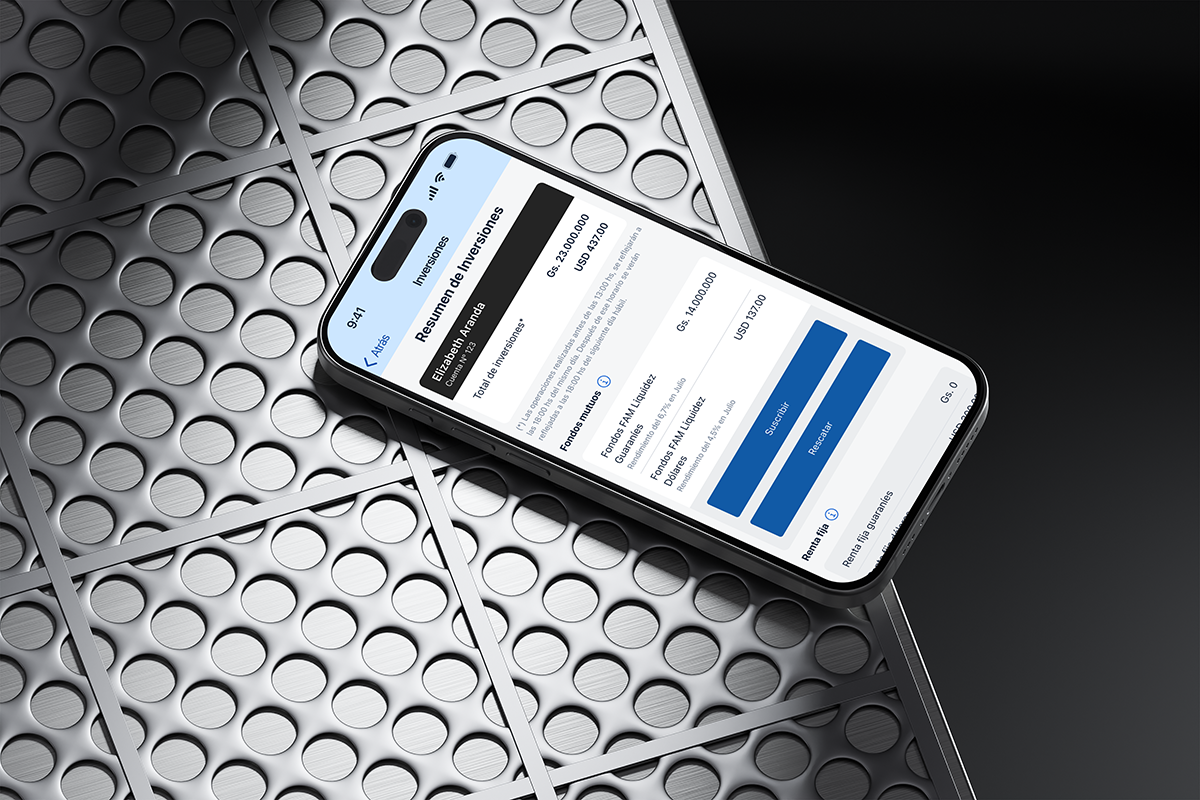

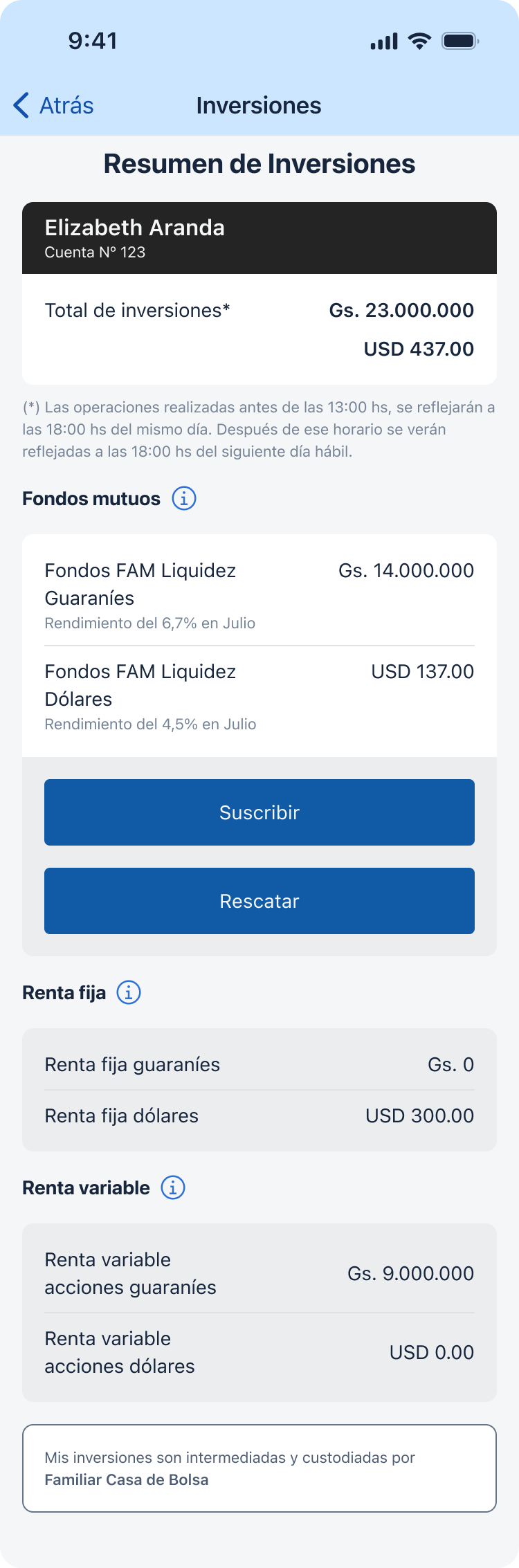

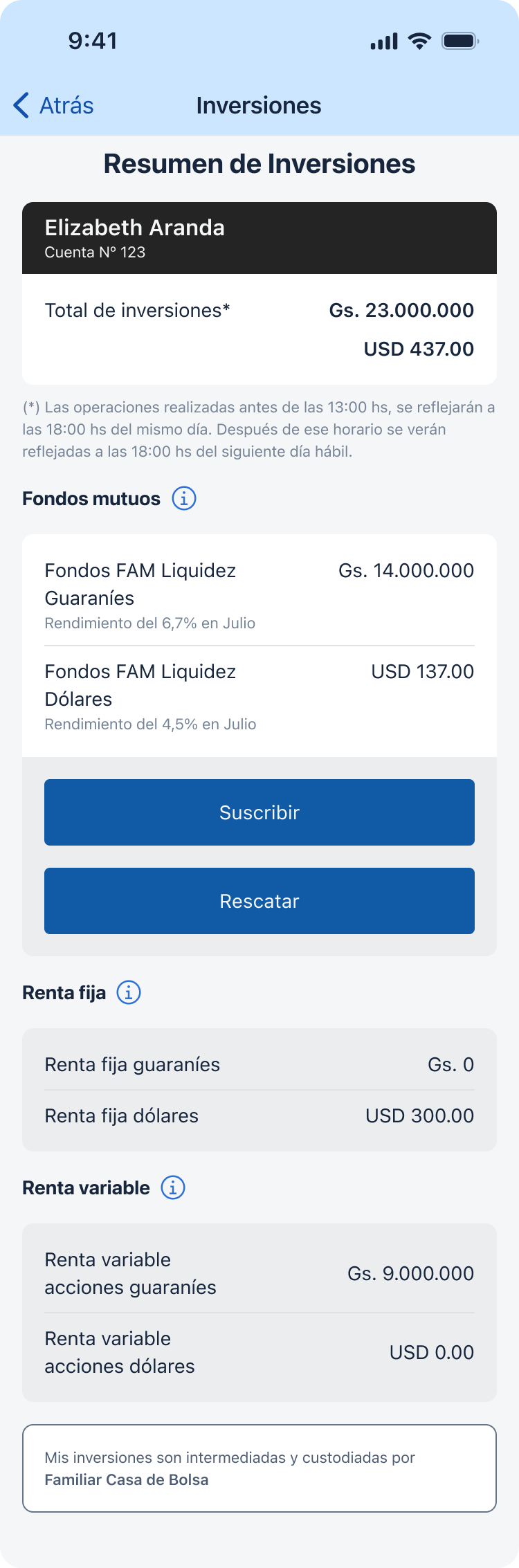

Unified Financial View: Provide customers with a single, clear dashboard view of their total wealth, displaying both primary bank balances and detailed investment portfolio performance in real-time, multi-currency format (₲ and USD).

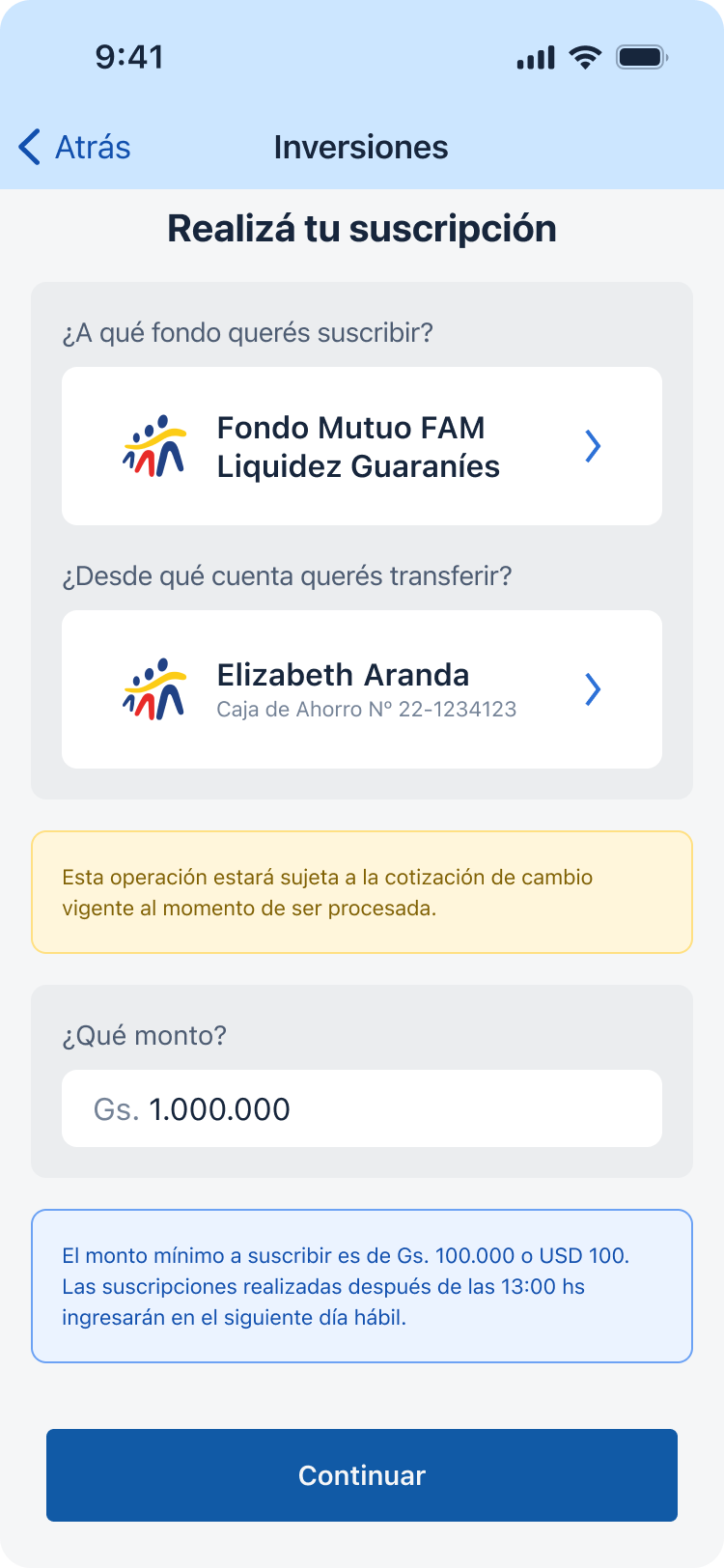

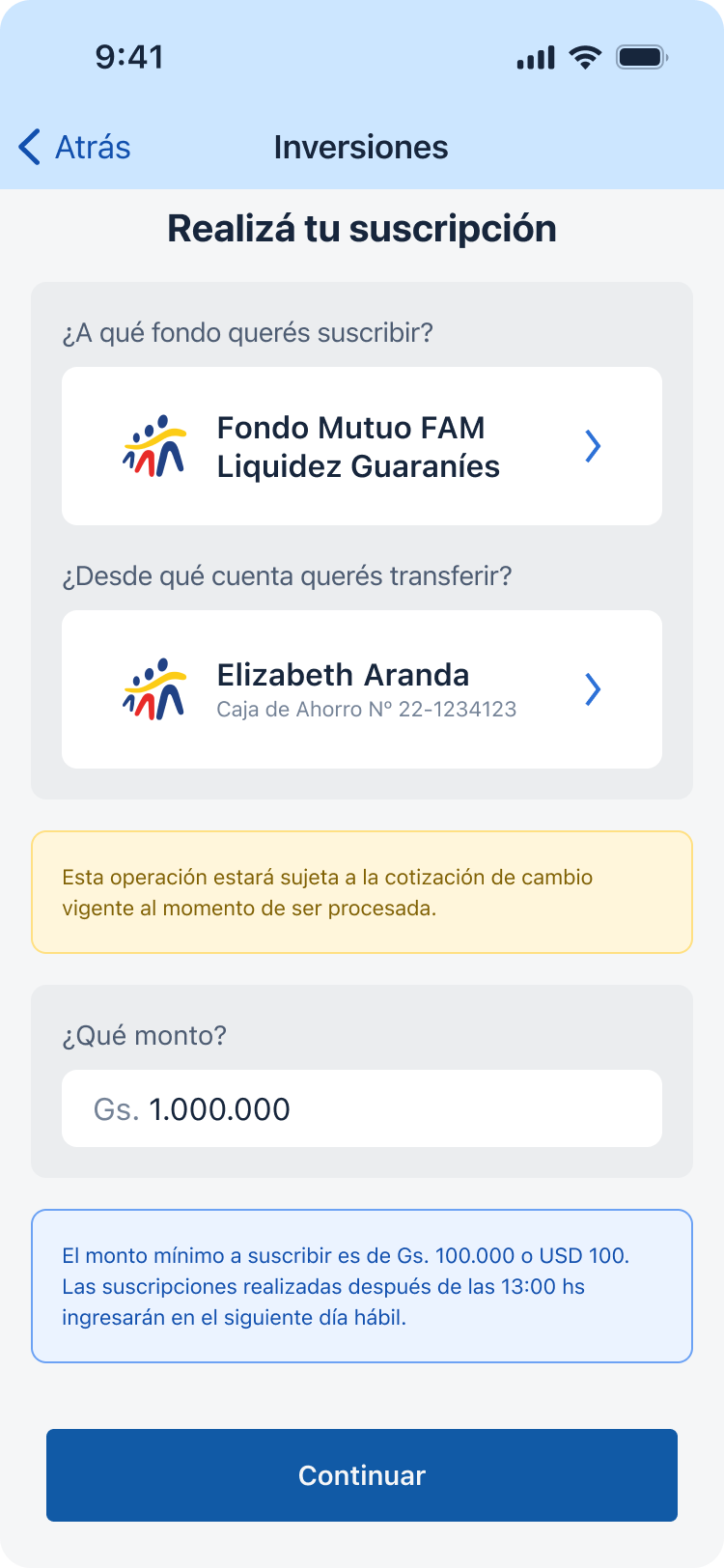

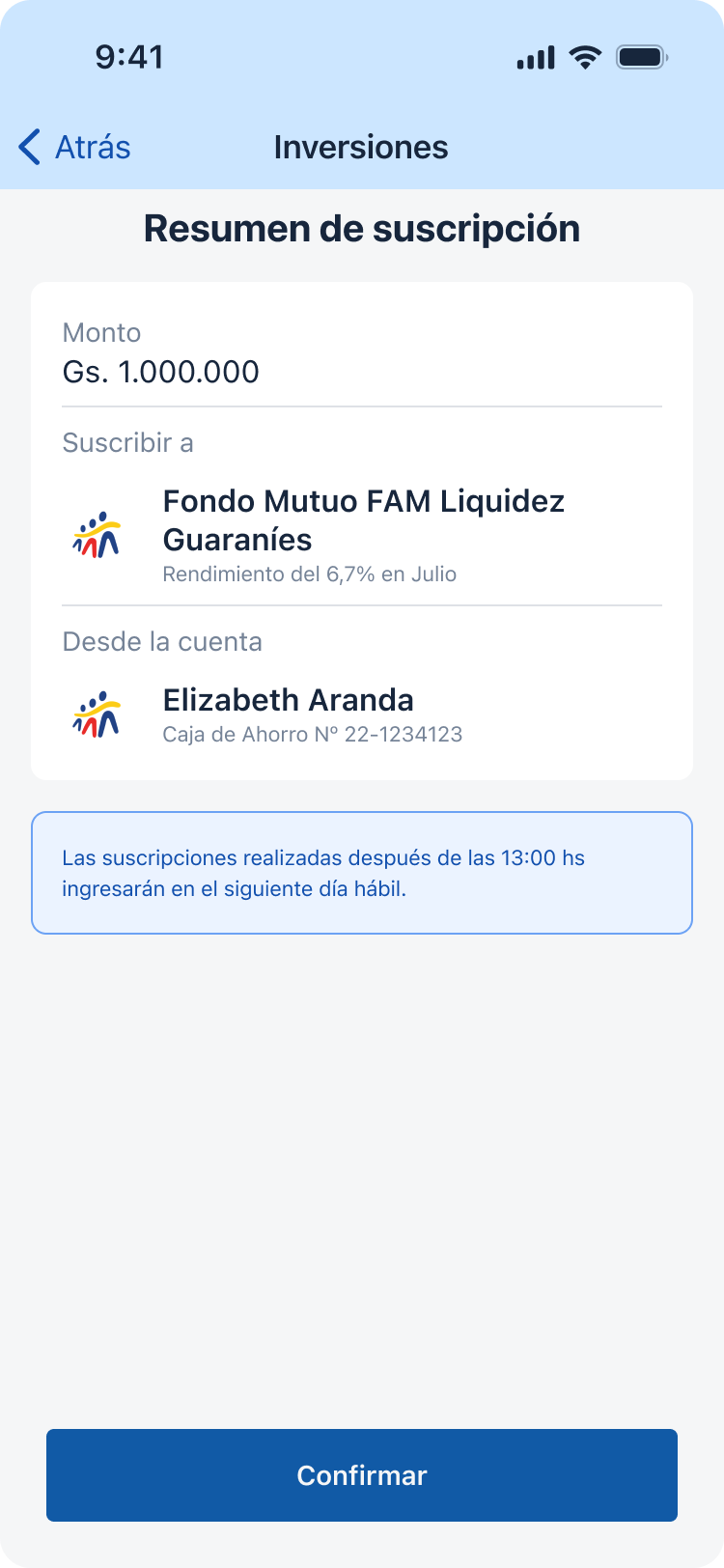

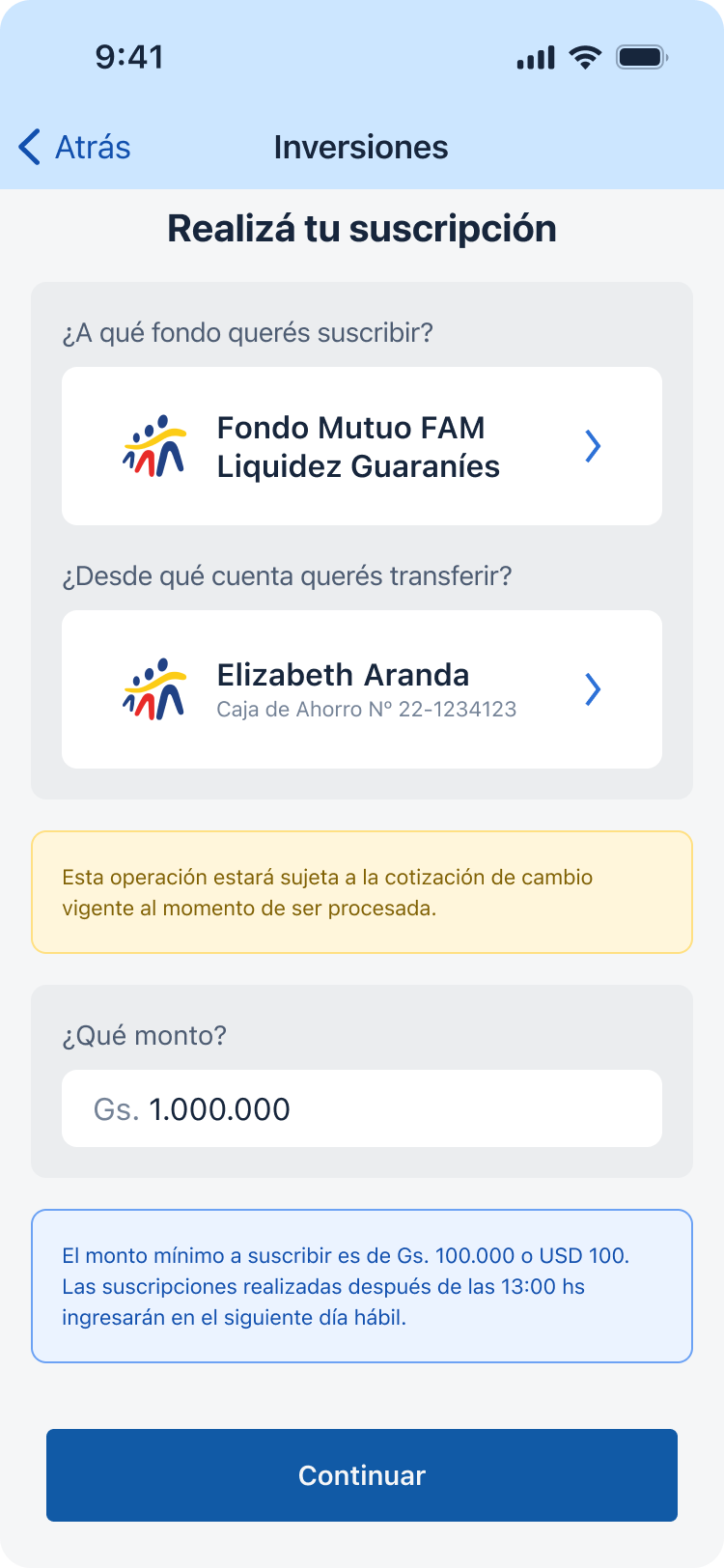

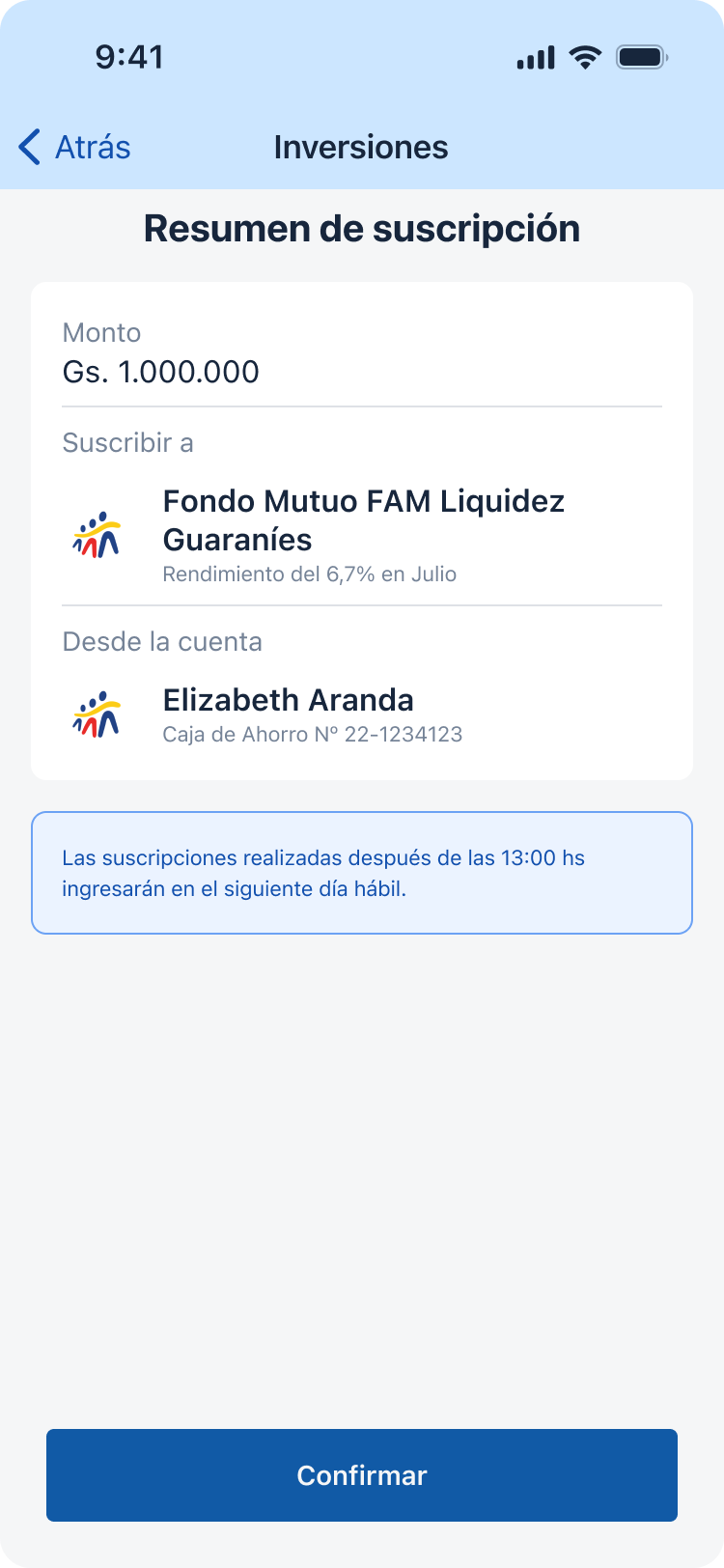

Drive Investment Activation: Design an intuitive, low-friction user flow for customers to add new funds to their existing investments and visualize potential earnings (fixed time or monthly percentages).

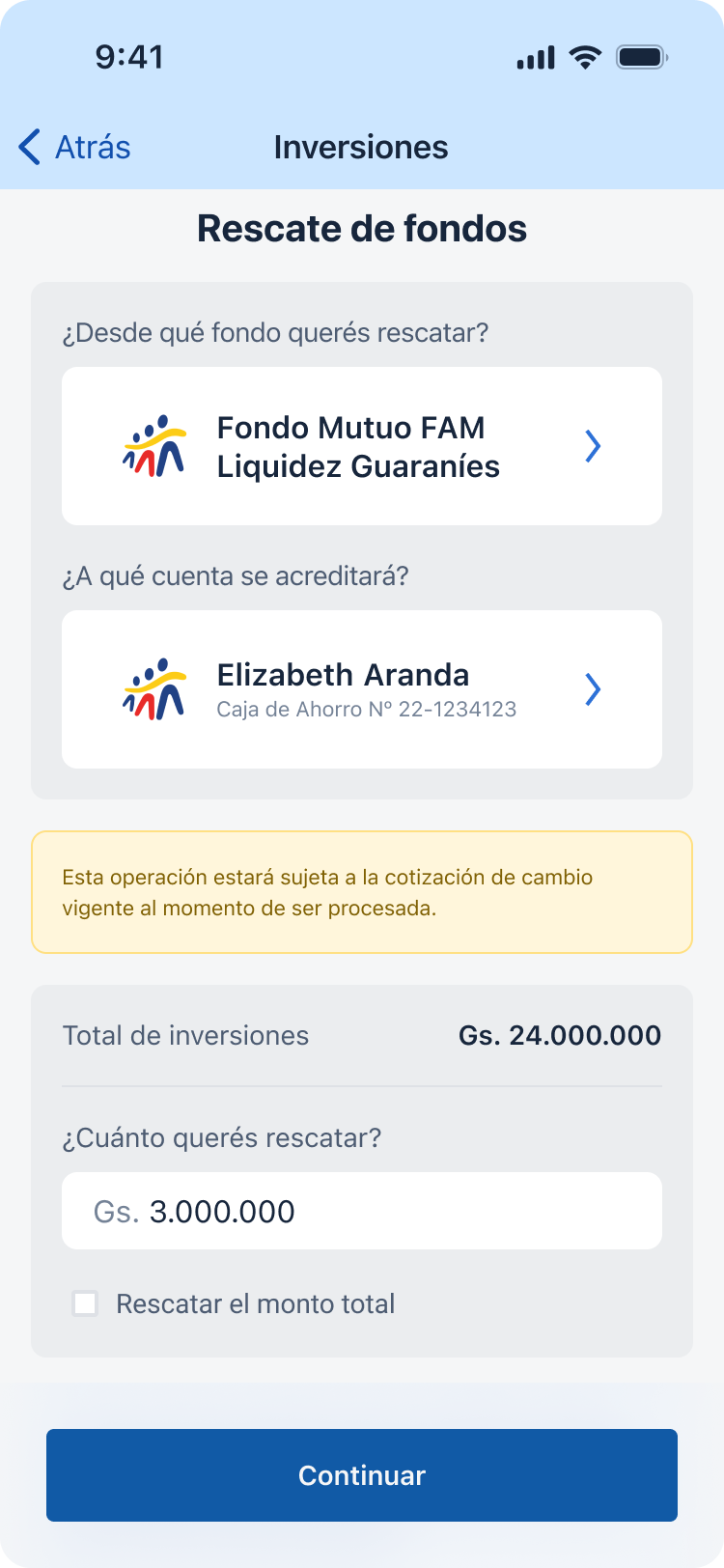

Enable Seamless Liquidity: Create a simple, secure process for users to request redemptions (withdrawals of capital and accumulated earnings) directly from the app, closing the loop between banking and brokerage services.

Harmonize Expectations & Compliance: Successfully meet the technical, security, and reporting requirements of both Banco Familiar and Familiar Casa de Bolsa through close cross-functional collaboration.

Team

1 Product Owner

1 UX/UI Designers

4 Backend Developers

2 Mobile Developers

2 QA Analysis

My role

Sr. UX/UI Designer

End-to-end UX/UI design

User-testing

Timeline

3 months

Fintech

About the bank

Banco Familiar S.A.E.C.A. is a key player in Paraguay's financial development, evolving from its founding in 1967 as Crédito Familiar to a full-service bank in 2009.

The bank's mission is to be the preferred bank for individuals and SMEs by offering comprehensive financial solutions (savings, credit, and services) that build long-term relationships of trust and drive mutual growth. It focuses on efficiency, honesty, and transparency to support personal and business projects across the country.

Context

Starting point

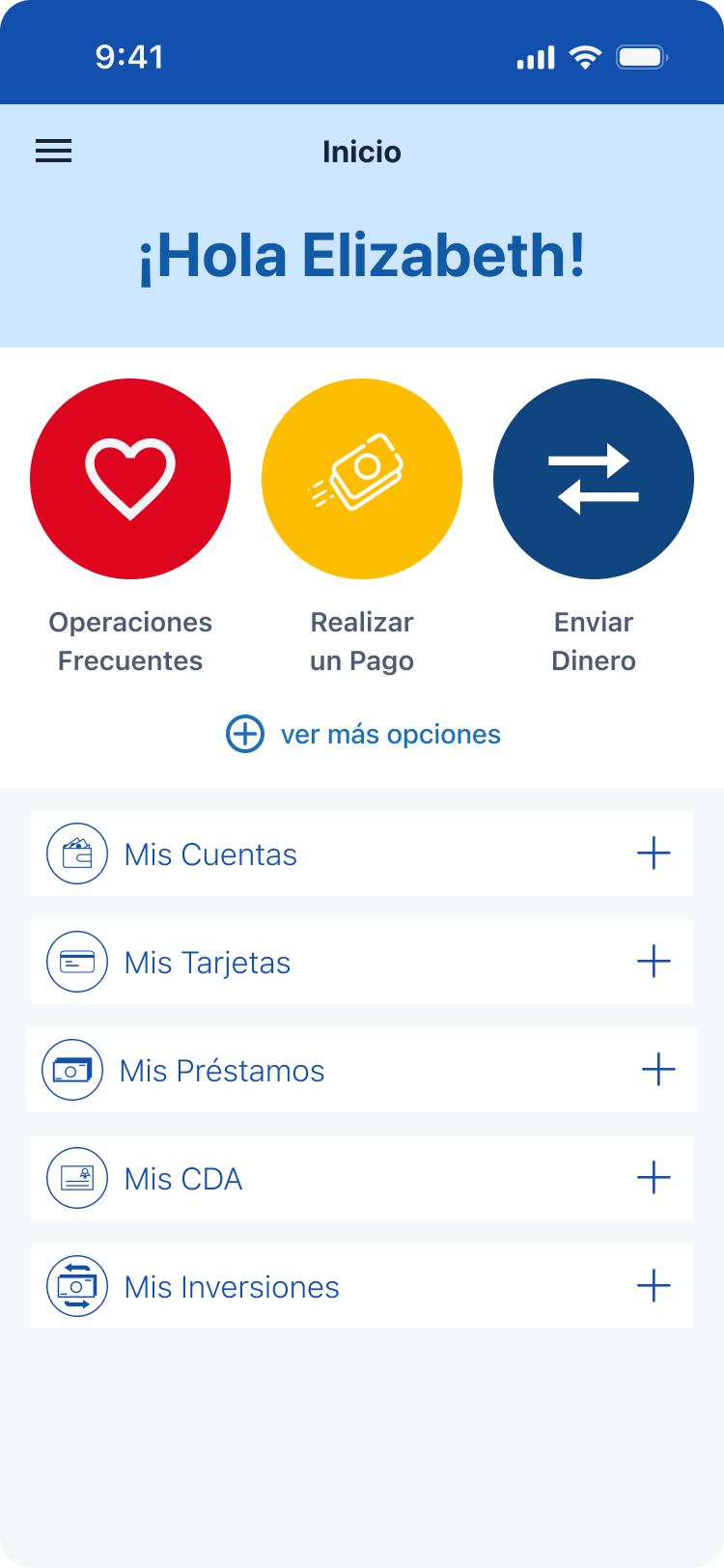

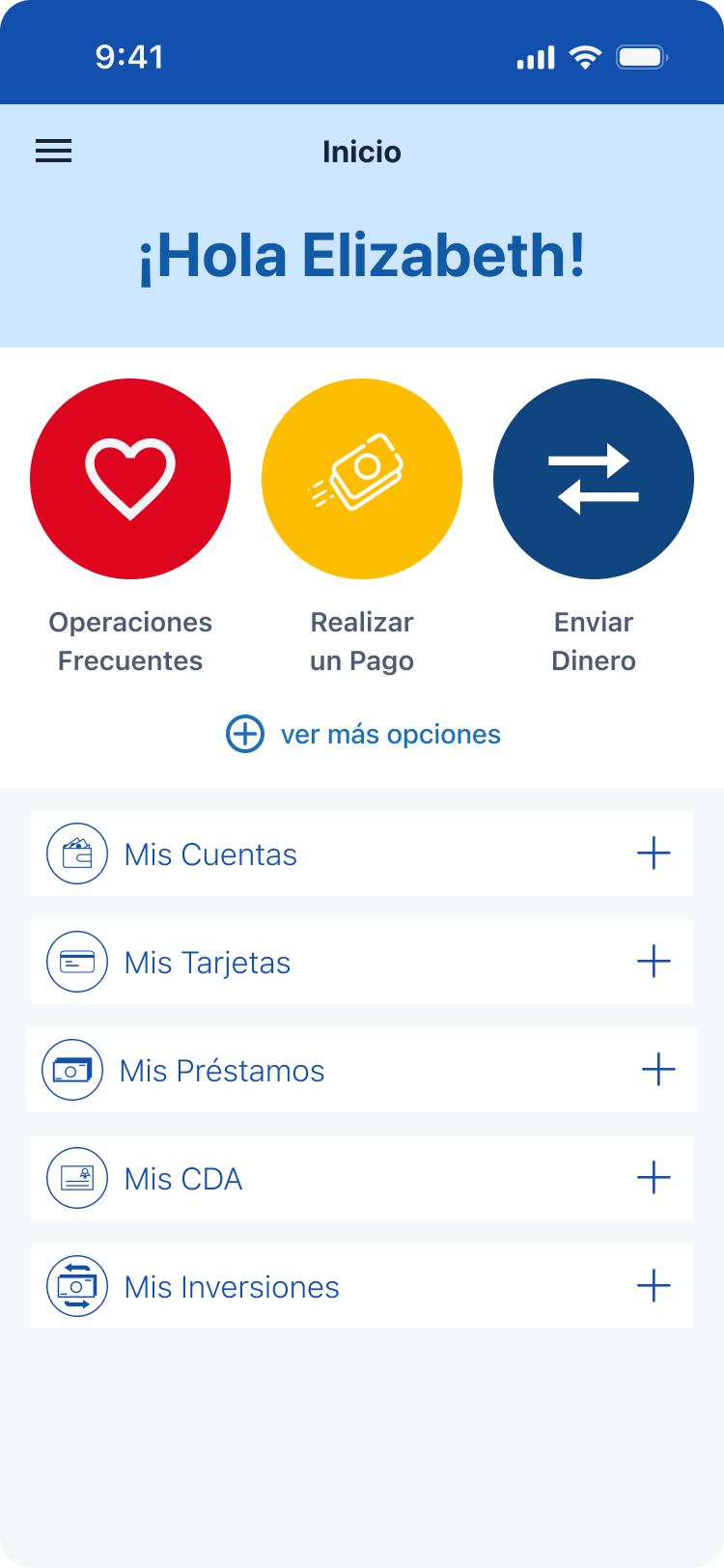

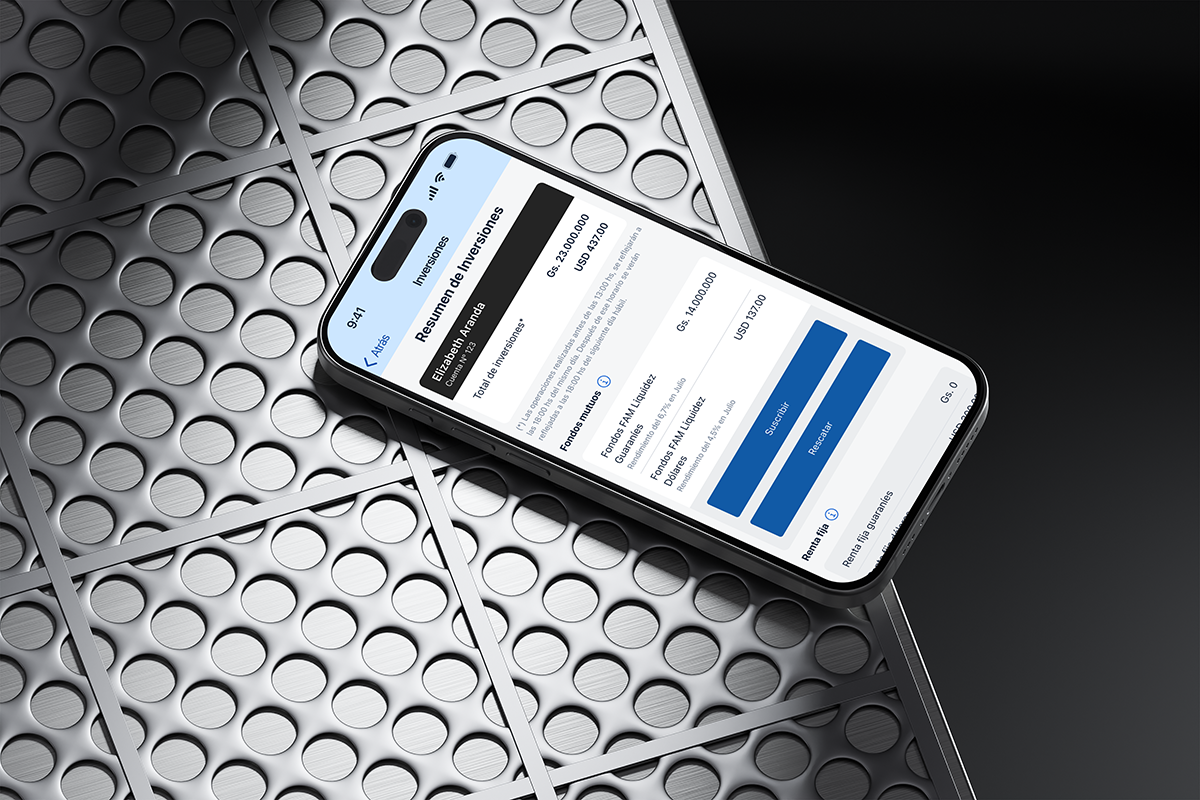

Disconnected Financial Ecosystem

Banking and investments were siloed across separate apps. Users lacked a unified view of their wealth, which resulted in a poor mental model and frequent confusion.

High Friction in Fund Allocation

Investment transactions were manual and cumbersome. Requiring inter-platform steps or call center help, this friction severely inhibited new investment activation and repeat funding.

Investment Visibility & Clarity Gap

No real-time multi-currency dashboard. Lacking immediate performance visibility in both ₲ and USD made the investment product opaque and undermined user trust.

Existing screens

Initial premise

Objective

User’s perspective

Ease the understanding of the product & deliver delight

Business

To drive higher user engagement and transactions

Tech

Seamlessly incorporate complex animations

Process

Our strategy for digitally integrating the banking and brokerage platforms was defined by close collaboration and a commitment to delivering a transparent, low-friction financial experience.

Deep Discovery & Problem Validation

The process began with a deep discovery phase combining internal data analysis and stakeholder workshops with both Banco Familiar and Familiar Casa de Bolsa. Our primary goal was to quantify the friction points caused by the financial ecosystem's fragmented nature.

This initial work validated the key issues: the massive barrier to investment created by the two systems being siloed across separate apps, the difficulty users faced in allocating and redeeming funds due to complex, manual inter-platform transfers, and the total lack of a real-time, multi-currency dashboard to accurately track performance in both Guaraníes (₲) and Dollars (USD).

Cross-Functional Design & Iteration

To ensure seamless integration and to successfully meet the distinct security, legal, and operational expectations of both the Bank and the Brokerage, we immediately initiated rapid design and iteration cycles. This required working very closely with cross-functional teams from both institutions:

- Joint Design Sprints: We held workshops with Engineering, Compliance, and Business teams from both entities to quickly validate every step of the investment flow (from adding funds to redemption), ensuring technical feasibility and strict adherence to joint regulatory requirements.

- Rapid Prototyping: Solutions were designed and tested iteratively, focusing on creating one unified, intuitive flow for managing investments, thereby eliminating the complex, manual steps previously required.

User-Driven Strategy & Multi-Currency Focus

Crucially, user journey mapping focused on the need for absolute clarity and trust in investment reporting. This highlighted the need to simplify complex brokerage concepts and prioritize immediate visibility.

Based on this insight, a key outcome of the process was the strategic visualization design that prioritized real-time, multi-currency display (₲ and USD) of both capital and revenue. This transparent dashboard was key to building user confidence, making the investment product feel clear, approachable, and integrated into their total financial life.

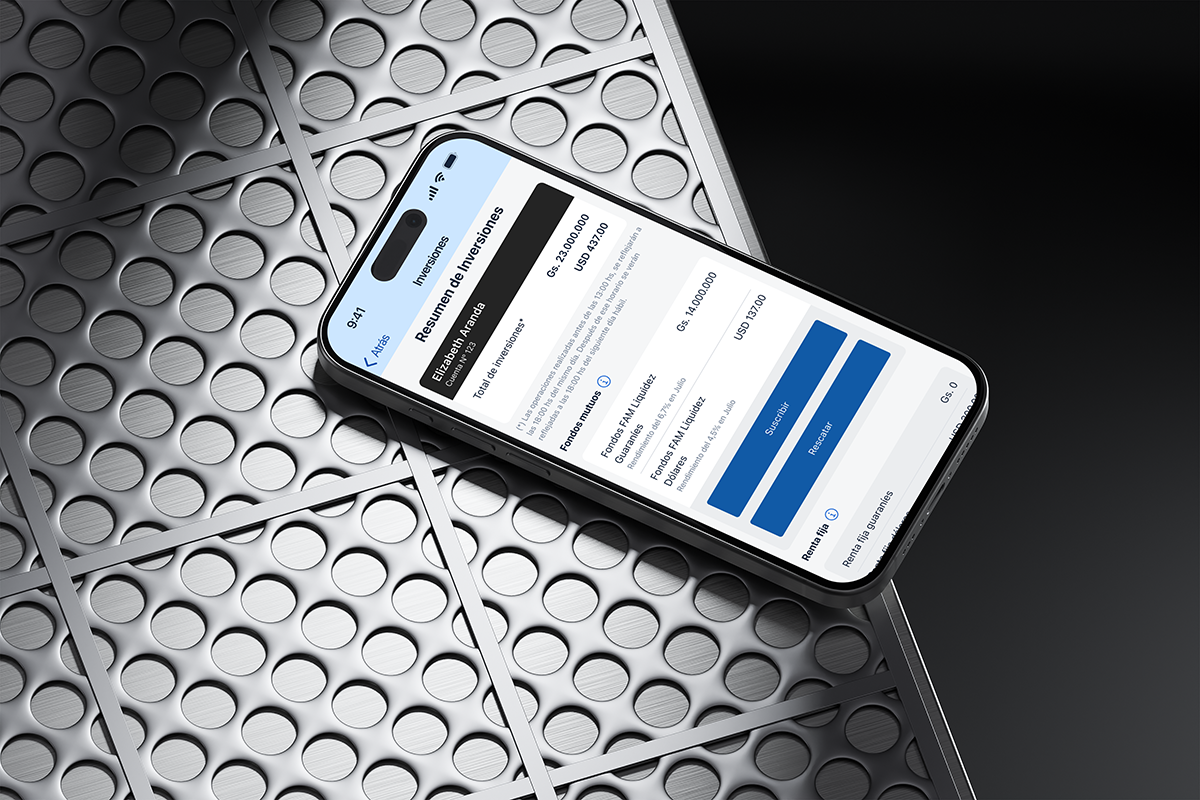

Product features

Deliverables

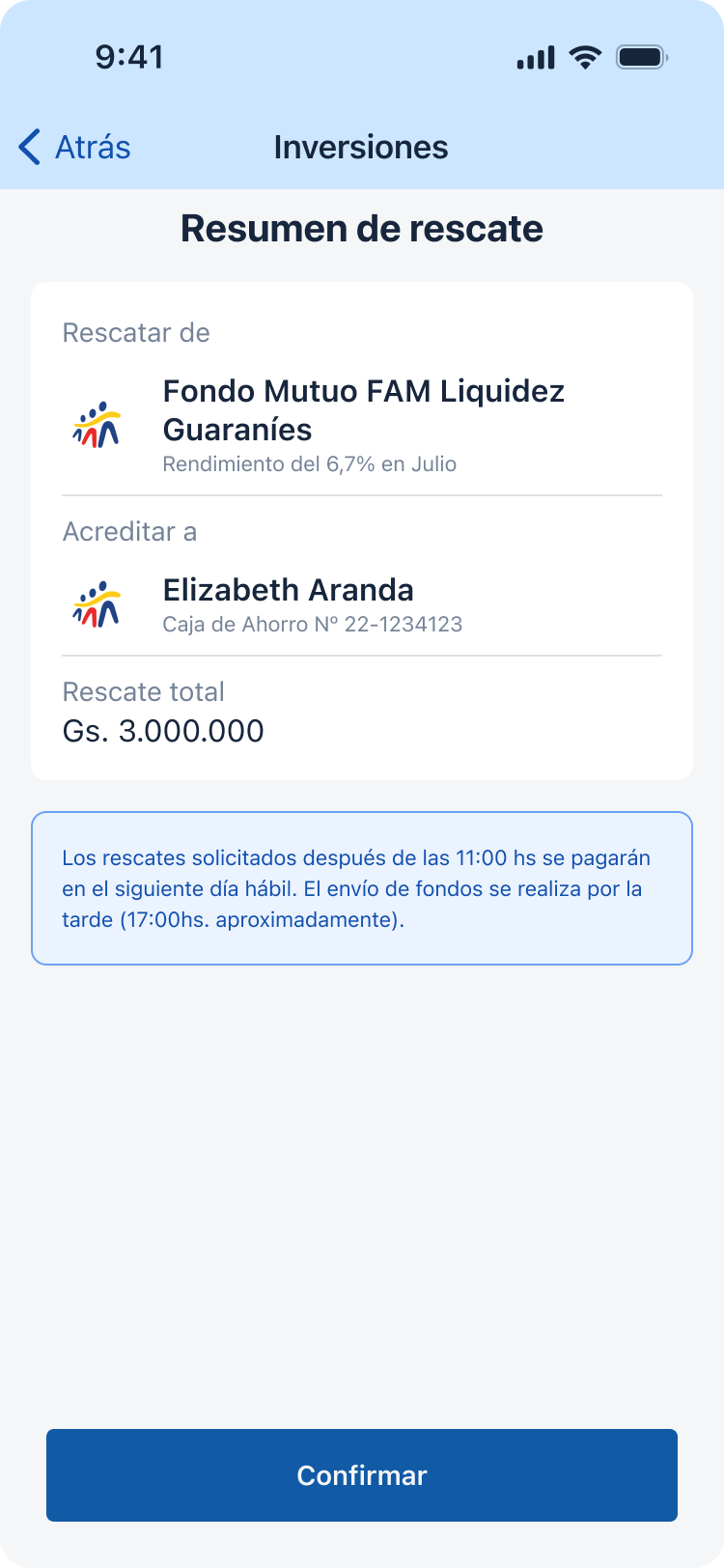

Investment

Feature

Dashboard update

Feature

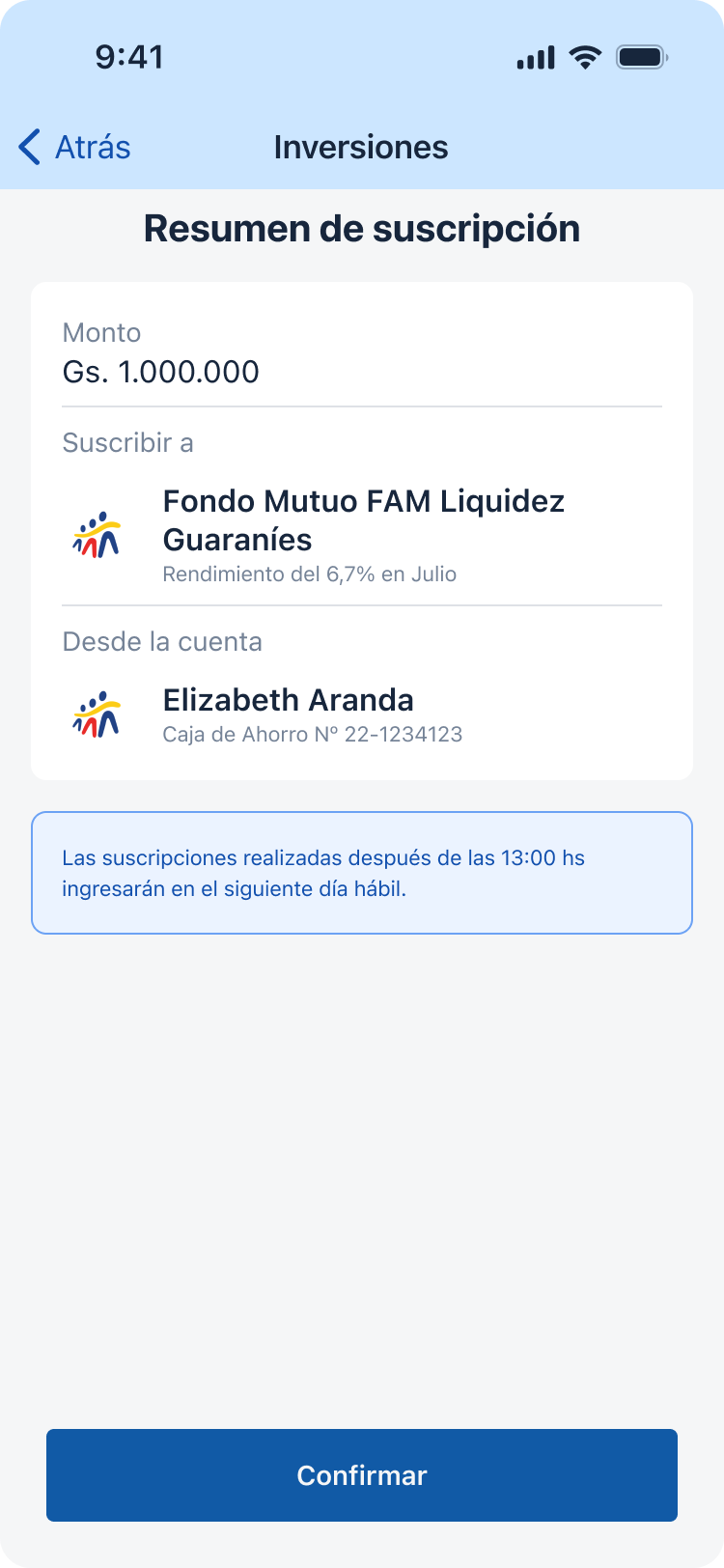

Add new funds

Feature

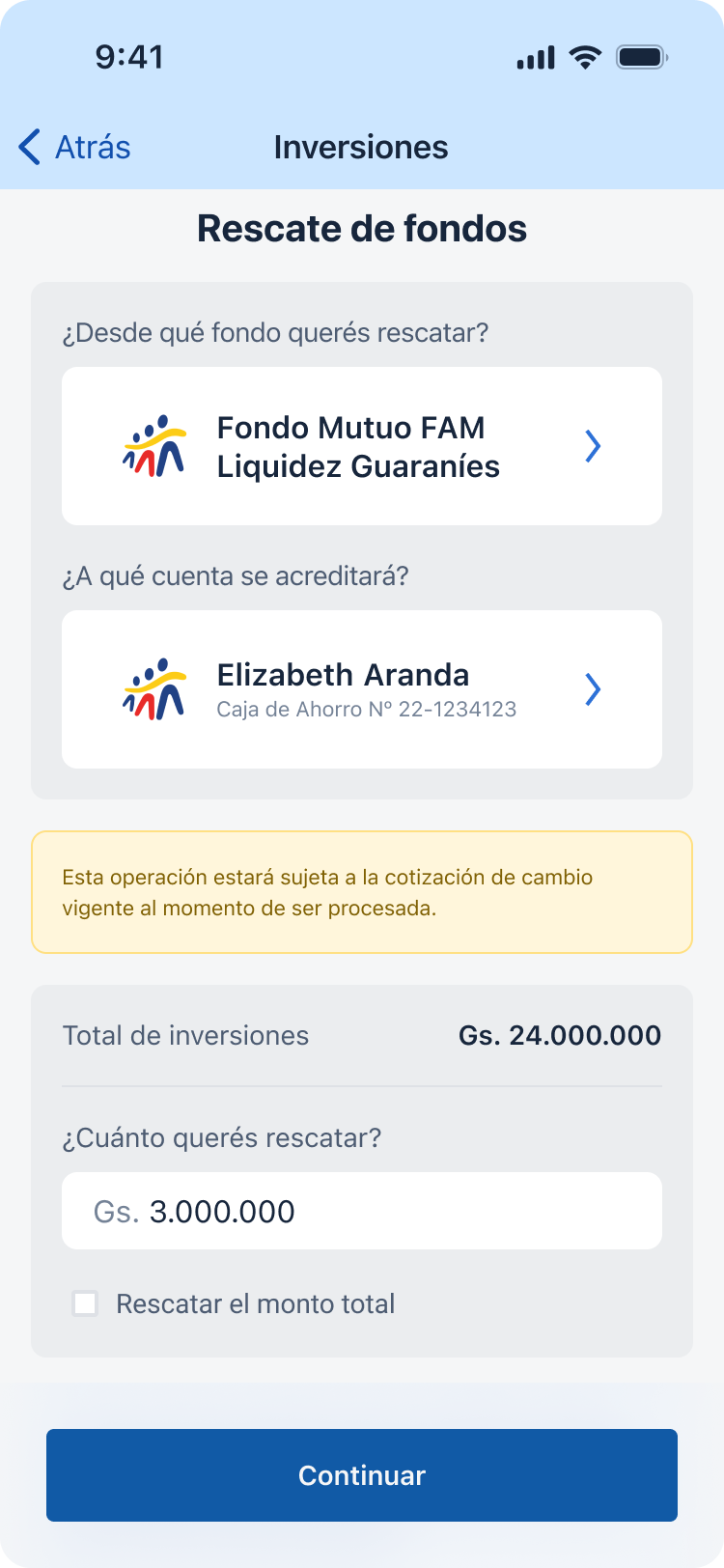

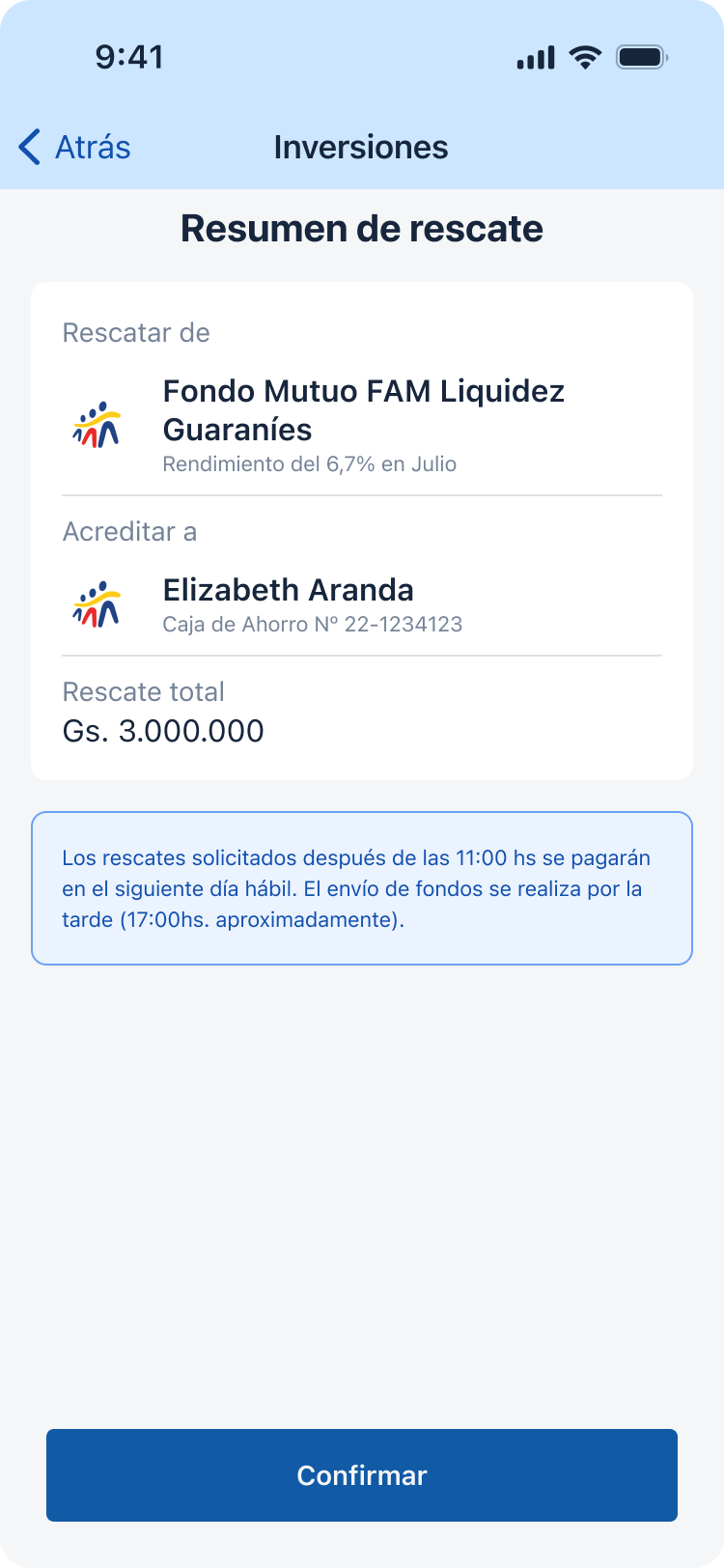

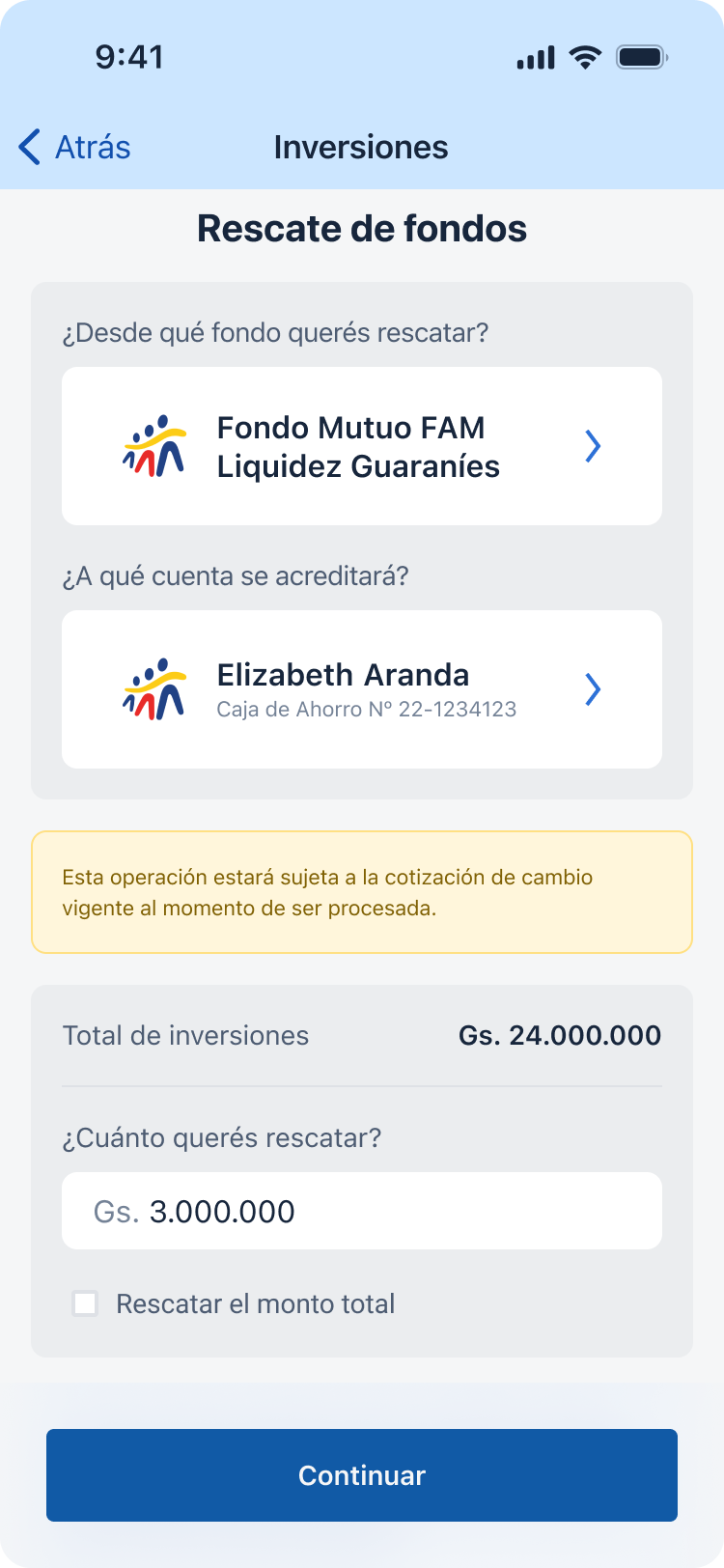

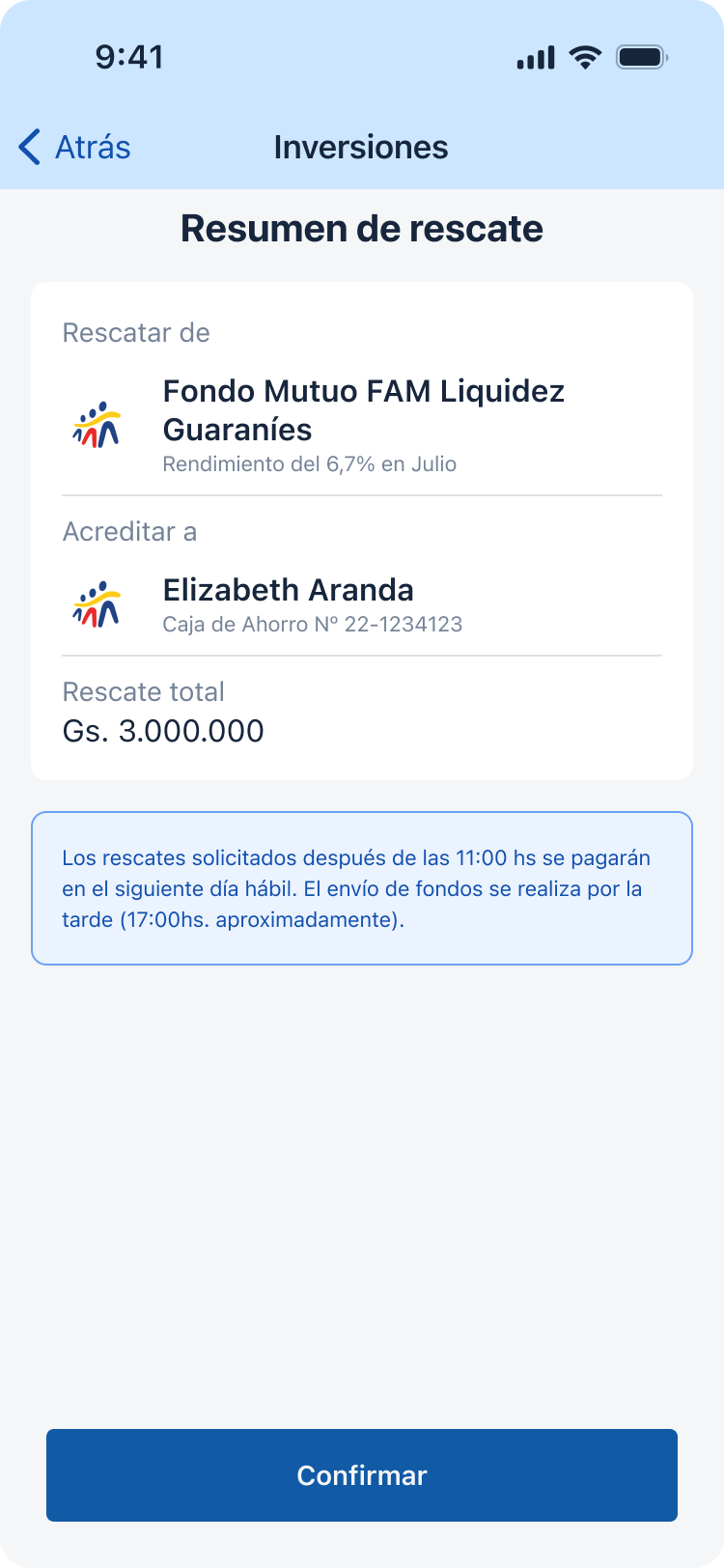

Retreve funds

Thanks for reading

Want to learn more?

Book a review

Back

Fintech

Investment Management

Book a review

Read more

+300K

Target users exposed

Over 29%

New investor activation

3 month

Integration timeline

Project Overview

Background

Banco Familiar, a leading financial institution, sought to enrich its core digital banking experience by providing customers with seamless access to sophisticated investment opportunities. The existing setup required customers to manage their primary banking and investment portfolios (run by Familiar Casa de Bolsa) across separate, disconnected platforms. This fragmentation created significant user friction, hindered cross-selling opportunities, and prevented customers from easily tracking their total financial health in one place.

Challenge

Design and integrate a comprehensive Investment Management module directly within the Banco Familiar mobile app. This module needed to securely display real-time investment data (capital and revenue) for both Guaraníes (₲) and Dollars (USD), enable effortless fund transfers for new investments, and support user-initiated redemptions (withdrawals and earnings) while meeting the distinct operational, legal, and security expectations of both the Bank and the Brokerage (Casa de Bolsa).

Objectives

Unified Financial View: Provide customers with a single, clear dashboard view of their total wealth, displaying both primary bank balances and detailed investment portfolio performance in real-time, multi-currency format (₲ and USD).

Drive Investment Activation: Design an intuitive, low-friction user flow for customers to add new funds to their existing investments and visualize potential earnings (fixed time or monthly percentages).

Enable Seamless Liquidity: Create a simple, secure process for users to request redemptions (withdrawals of capital and accumulated earnings) directly from the app, closing the loop between banking and brokerage services.

Harmonize Expectations & Compliance: Successfully meet the technical, security, and reporting requirements of both Banco Familiar and Familiar Casa de Bolsa through close cross-functional collaboration.

Team

1 Product Owner

1 UX/UI Designers

4 Backend Developers

2 Mobile Developers

2 QA Analysis

My role

Sr. UX/UI Designer

End-to-end UX/UI design

User-testing

Timeline

3 months

Fintech

About the bank

Banco Familiar S.A.E.C.A. is a key player in Paraguay's financial development, evolving from its founding in 1967 as Crédito Familiar to a full-service bank in 2009.

The bank's mission is to be the preferred bank for individuals and SMEs by offering comprehensive financial solutions (savings, credit, and services) that build long-term relationships of trust and drive mutual growth. It focuses on efficiency, honesty, and transparency to support personal and business projects across the country.

Context

Starting point

Disconnected Financial Ecosystem

Banking and investments were siloed across separate apps. Users lacked a unified view of their wealth, which resulted in a poor mental model and frequent confusion.

High Friction in Fund Allocation

Investment transactions were manual and cumbersome. Requiring inter-platform steps or call center help, this friction severely inhibited new investment activation and repeat funding.

Investment Visibility & Clarity Gap

No real-time multi-currency dashboard. Lacking immediate performance visibility in both ₲ and USD made the investment product opaque and undermined user trust.

Existing screens

Initial premise

Objective

User’s perspective

Ease the understanding of the product & deliver delight

Business

To drive higher user engagement and transactions

Tech

Seamlessly incorporate complex animations

Process

Our strategy for digitally integrating the banking and brokerage platforms was defined by close collaboration and a commitment to delivering a transparent, low-friction financial experience.

Deep Discovery & Problem Validation

The process began with a deep discovery phase combining internal data analysis and stakeholder workshops with both Banco Familiar and Familiar Casa de Bolsa. Our primary goal was to quantify the friction points caused by the financial ecosystem's fragmented nature.

This initial work validated the key issues: the massive barrier to investment created by the two systems being siloed across separate apps, the difficulty users faced in allocating and redeeming funds due to complex, manual inter-platform transfers, and the total lack of a real-time, multi-currency dashboard to accurately track performance in both Guaraníes (₲) and Dollars (USD).

Cross-Functional Design & Iteration

To ensure seamless integration and to successfully meet the distinct security, legal, and operational expectations of both the Bank and the Brokerage, we immediately initiated rapid design and iteration cycles. This required working very closely with cross-functional teams from both institutions:

- Joint Design Sprints: We held workshops with Engineering, Compliance, and Business teams from both entities to quickly validate every step of the investment flow (from adding funds to redemption), ensuring technical feasibility and strict adherence to joint regulatory requirements.

- Rapid Prototyping: Solutions were designed and tested iteratively, focusing on creating one unified, intuitive flow for managing investments, thereby eliminating the complex, manual steps previously required.

User-Driven Strategy & Multi-Currency Focus

Crucially, user journey mapping focused on the need for absolute clarity and trust in investment reporting. This highlighted the need to simplify complex brokerage concepts and prioritize immediate visibility.

Based on this insight, a key outcome of the process was the strategic visualization design that prioritized real-time, multi-currency display (₲ and USD) of both capital and revenue. This transparent dashboard was key to building user confidence, making the investment product feel clear, approachable, and integrated into their total financial life.

Product features

Deliverables

Investment

Feature

Dashboard update

Feature

Add new funds

Feature

Retreve funds

Thanks for reading

Want to learn more?

Book a review

Back

Fintech

Investment Management

Book a review

Read more

+200K

Target users exposed

Over 29%

New investor activation

3 month

Integration timeline

Project Overview

Background

Banco Familiar, a leading financial institution, sought to enrich its core digital banking experience by providing customers with seamless access to sophisticated investment opportunities. The existing setup required customers to manage their primary banking and investment portfolios (run by Familiar Casa de Bolsa) across separate, disconnected platforms. This fragmentation created significant user friction, hindered cross-selling opportunities, and prevented customers from easily tracking their total financial health in one place.

Challenge

Design and integrate a comprehensive Investment Management module directly within the Banco Familiar mobile app. This module needed to securely display real-time investment data (capital and revenue) for both Guaraníes (₲) and Dollars (USD), enable effortless fund transfers for new investments, and support user-initiated redemptions (withdrawals and earnings) while meeting the distinct operational, legal, and security expectations of both the Bank and the Brokerage (Casa de Bolsa).

Objectives

Unified Financial View: Provide customers with a single, clear dashboard view of their total wealth, displaying both primary bank balances and detailed investment portfolio performance in real-time, multi-currency format (₲ and USD).

Drive Investment Activation: Design an intuitive, low-friction user flow for customers to add new funds to their existing investments and visualize potential earnings (fixed time or monthly percentages).

Enable Seamless Liquidity: Create a simple, secure process for users to request redemptions (withdrawals of capital and accumulated earnings) directly from the app, closing the loop between banking and brokerage services.

Harmonize Expectations & Compliance: Successfully meet the technical, security, and reporting requirements of both Banco Familiar and Familiar Casa de Bolsa through close cross-functional collaboration.

Team

1 Product Owner

1 UX/UI Designers

4 Backend Developers

2 Mobile Developers

2 QA Analysis

My role

Sr. UX/UI Designer

End-to-end UX/UI design

User-testing

Timeline

3 months

Fintech

About the bank

Banco Familiar S.A.E.C.A. is a key player in Paraguay's financial development, evolving from its founding in 1967 as Crédito Familiar to a full-service bank in 2009.

The bank's mission is to be the preferred bank for individuals and SMEs by offering comprehensive financial solutions (savings, credit, and services) that build long-term relationships of trust and drive mutual growth. It focuses on efficiency, honesty, and transparency to support personal and business projects across the country.

Context

Starting point

Disconnected Financial Ecosystem

Banking and investments were siloed across separate apps. Users lacked a unified view of their wealth, which resulted in a poor mental model and frequent confusion.

High Friction in Fund Allocation

Investment transactions were manual and cumbersome. Requiring inter-platform steps or call center help, this friction severely inhibited new investment activation and repeat funding.

Investment Visibility & Clarity Gap

No real-time multi-currency dashboard. Lacking immediate performance visibility in both ₲ and USD made the investment product opaque and undermined user trust.

Existing screens

Initial premise

Objective

User’s perspective

Ease the understanding of the product & deliver delight

Business

To drive higher user engagement and transactions

Tech

Seamlessly incorporate complex animations

Process

Our strategy for digitally integrating the banking and brokerage platforms was defined by close collaboration and a commitment to delivering a transparent, low-friction financial experience.

Deep Discovery & Problem Validation

The process began with a deep discovery phase combining internal data analysis and stakeholder workshops with both Banco Familiar and Familiar Casa de Bolsa. Our primary goal was to quantify the friction points caused by the financial ecosystem's fragmented nature.

This initial work validated the key issues: the massive barrier to investment created by the two systems being siloed across separate apps, the difficulty users faced in allocating and redeeming funds due to complex, manual inter-platform transfers, and the total lack of a real-time, multi-currency dashboard to accurately track performance in both Guaraníes (₲) and Dollars (USD).

Cross-Functional Design & Iteration

To ensure seamless integration and to successfully meet the distinct security, legal, and operational expectations of both the Bank and the Brokerage, we immediately initiated rapid design and iteration cycles. This required working very closely with cross-functional teams from both institutions:

- Joint Design Sprints: We held workshops with Engineering, Compliance, and Business teams from both entities to quickly validate every step of the investment flow (from adding funds to redemption), ensuring technical feasibility and strict adherence to joint regulatory requirements.

- Rapid Prototyping: Solutions were designed and tested iteratively, focusing on creating one unified, intuitive flow for managing investments, thereby eliminating the complex, manual steps previously required.

User-Driven Strategy & Multi-Currency Focus

Crucially, user journey mapping focused on the need for absolute clarity and trust in investment reporting. This highlighted the need to simplify complex brokerage concepts and prioritize immediate visibility.

Based on this insight, a key outcome of the process was the strategic visualization design that prioritized real-time, multi-currency display (₲ and USD) of both capital and revenue. This transparent dashboard was key to building user confidence, making the investment product feel clear, approachable, and integrated into their total financial life.

Product features

Deliverables

Investment

Feature

Dashboard update

Feature

Add new funds

Feature

Retrieve funds

Thanks for reading

Want to learn more?

Book a review